Want to find the right Wayhome for you?

Click below to get customized recommendations

Request a WayhomeImagine this: you’ve just landed a short-term work assignment, are testing out a new city to see if it fits your needs and lifestyle, or you’re in between homes while waiting for your next place to be ready. You only need housing for two months—maybe less.

You might think you can rent an apartment or house for just a few months, but it’s not always that simple. While the monthly rent may look cheaper on paper, most leases lock you into a full year you don’t actually need. Ending early comes with steep penalties, and you’ll still be responsible for furnishing the place, setting up utilities, and dealing with the hassle of moving twice in a short span.

It’s a frustrating middle ground: you don’t want to overpay, but you also don’t want to be trapped.

Enter Wayhome, a platform designed for these types of situations. It offers homes with bundled utilities and furniture, aiming to reduce upfront costs and avoid long-term commitments. While savings will vary depending on the market, timing, and specific property, in some cases it can come close to—or even slightly under—what you might spend with a traditional lease once you factor in all the typical upfront fees and penalties.

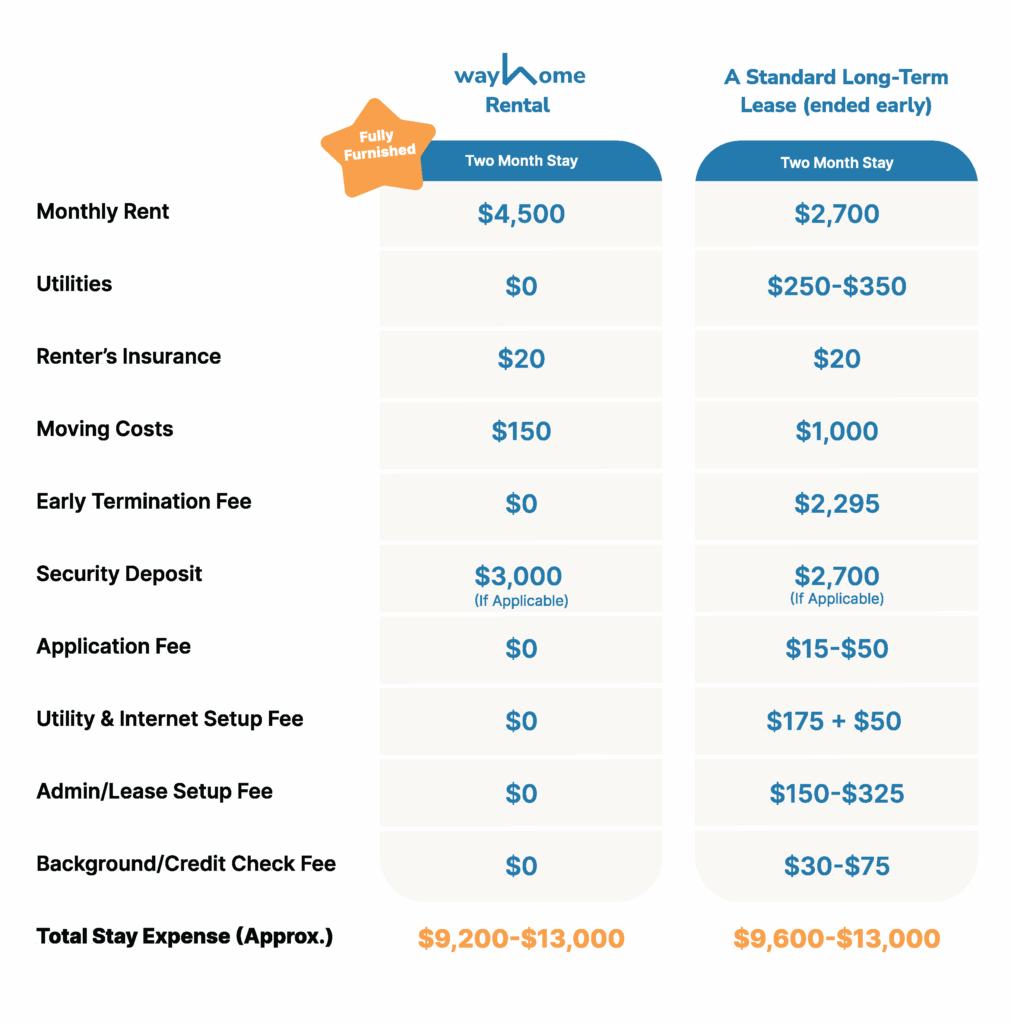

To prove it, we ran a real-world case study in San Antonio, Texas—a market with a mix of affordable long-term leases and pricey short-term stays. We compared a 2-month stay in a Wayhome rental against a standard long-term lease for the same size and type of home, factoring in rent, utilities, insurance, one-time fees, and early termination costs.

The results? Wayhome reduced some of the stress and inflexibility of a traditional lease and, in certain cases, could help renters save money. Let’s break it down.

The Hidden Costs of a “Cheaper” Lease

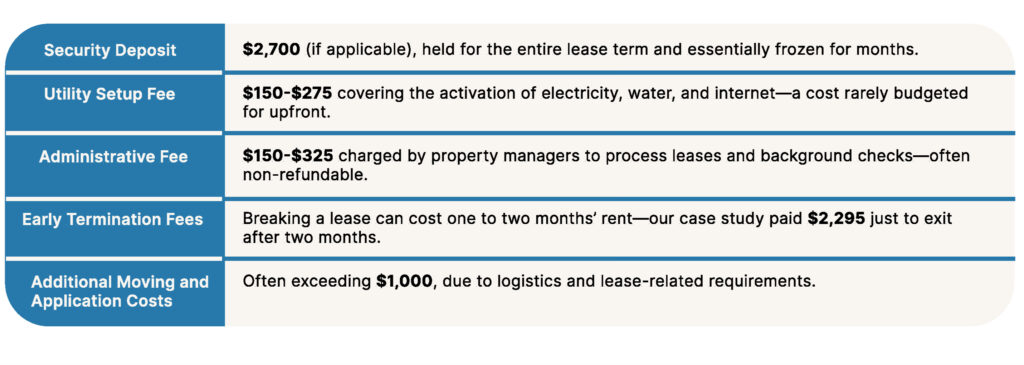

At first glance, long-term leases often appear more affordable because of their lower monthly rent. However, this initial sticker price masks a significant hidden cost: the large one-time fees, penalties, and deposits that landlords and property managers require upfront—or when you need to leave early.

In our San Antonio, Texas case study, we compared the real costs of a two-month stay in a home rental roughly 2,000 sq. ft. with 3 bedrooms and 2 full baths under a standard long-term lease versus a Wayhome rental of the same size and type.

The numbers below reflect actual fees and charges renters would encounter in that market:

For renters on a budget or those relocating with limited savings, these upfront and mid-lease costs can be prohibitive, delaying or even preventing the move altogether.

By contrast, Wayhome can reduce some of these financial barriers, often requiring minimal upfront payment beyond your monthly rent and no penalties for shorter stays. This can help renters better manage costs for essentials like groceries, transportation, or emergencies, offering added flexibility during what can be a stressful transition.

The San Antonio Case Study: Wayhome vs. the Alternatives

When you add it all up, the “cheaper” long-term lease can quickly become the most expensive choice—especially if you need to move out early or relocate again. Early termination fees and the cost of moving twice can erase any savings, leaving you paying for a place you’re no longer living in.

To see just how significant the difference can be, we ran the numbers in a real-world example. Using actual listings, fee schedules, and moving quotes from San Antonio, Texas, we compared a 2-month stay in:

- A Wayhome rental

- A standard long-term lease (ended early)

Here’s how the costs for a two-month stay stack up:

Total stay expenses are presented as an approximate range, as they can fluctuate based on factors such as the rental’s size, features, location, and other variable costs that may differ depending on individual circumstances.

While Wayhome’s monthly rent is higher, it eliminates large upfront costs and spares you from early lease termination fees. For someone who might need to move sooner than expected, it could be less stressful and can even end up slightly cheaper or comparable to committing to a traditional lease you might have to break.

Why Wayhome Came Out Ahead

While Wayhome’s rent comes in at or near the cost of a long-term lease, what really sets it apart is the convenience and the far less amount of work involved. A long-term lease may look cheaper on paper, but the hidden costs show up in the form of time, effort, and stress.

With a traditional lease, you’d have to move in, set up the house, and transfer utilities—all just to undo it again two months later. That means deposits, service calls, and account transfers that eat up your time for a stay that’s supposed to be temporary. And it doesn’t stop there: setting up a bed, moving a washer/dryer, or hauling a refrigerator are big jobs once, let alone twice in a short span. Doing all of that again just a few months later is not only annoying, it’s exhausting—especially when you’re busy with other priorities.

Wayhome makes all of that disappear by being designed for short-term living:

- Move-in ready: Furniture, utilities, and insurance are already bundled into one monthly payment.

- Minimal hassle: minimal upfront fees, no utility transfers, no setup headaches.

- Stress-free: You don’t have to move appliances or furniture twice in a matter of months.

Instead of wasting weekends with movers, utility companies, or appliance setups, you can simply walk in, drop your bags, and focus on the things that actually matter.

The Bottom Line

At first glance, a traditional lease might look cheaper if you’re only comparing monthly rent. But the reality is that the hidden costs aren’t just financial—they’re logistical. Security deposits, utility setup, early termination penalties, and the sheer hassle of moving furniture and appliances more than once all pile up quickly.

Wayhome eliminates those headaches. Everything is move-in ready—furniture, utilities, and insurance are bundled into one payment—so you don’t waste time setting up or breaking down a home you’ll only live in for a short stretch. That means no coordinating movers, no transferring accounts, and no repeating the process just a couple months later.

The real value isn’t just about saving money—it’s about saving yourself from the cycle of packing, hauling, and setting up again and again. Wayhome gives you the flexibility to move on your own timeline without the stress, making it the smarter choice when life demands convenience.

Want to find the right Wayhome for you?

Click below to get customized recommendations

Request a Wayhome